投资拉美的现状���、趋势及相关建议

2019-10-11

目前中国已成为拉美地区的第二大贸易伙伴国���,拉美也成为仅次于亚洲的中国海外投资第二大目的地。截至2017年���,中资企业在拉美的直接投资存量已达到3870亿美元。中国在拉美的投资主要集中在资源���、制造业���、服务业等领域���,2017年来自中国私营部门的投资达到全部投资拉美总额的68.89%。2019年9月18日���,k8凯发天生赢家·一触即发应邀出席由Legal500和Affinitas共同举办的“投资拉美”圆桌会议���,k8凯发天生赢家·一触即发北京办公室合伙人���、一带一路服务机制秘书长贾辉律师应邀出席会议���,同来自墨西哥���、哥伦比亚���、秘鲁和智利的律师一起分享了企业投资拉美的现状���、趋势及相关建议。

Doing Business in Latin America

On September 18th, representatives of DeHeng Law Offices were invited to attend the roundtable meeting on “Doing Business in Latin America” organized by the Legal 500 and Affinitas. The roundtable meeting brought together a number of the leading partners from international and domestic firms in China to discuss the matters they advised on and the challenges they faced in Latin America. Affinitas member firms in Mexico, Colombia, Peru and Chile also attended the meeting and shared their experiences of the local market. Mr. Harrison Jia, Partner of DeHeng Law Office and Secretary General of Belt &Road Service Connections, was invited to attend such meeting and shared his thoughts as below on “Doing Business in Latin America”:

1.Have you seen an evolution of types of Chinese investors/businesses taking an interest in the Latin American market (and especially in Mexico, Colombia, Peru and Chile)?

DeHeng has advised the clients on the sectors of agriculture, mining, infrastructure, manufacturing, services, etc. The sectors in which China invests in Latin America are becoming more diversified. Since 2000, Chinese investment in Latin America has focused on the following three sectors: raw materials, manufacturing, services and domestic markets. Initially, China’s investment in Latin America was mainly in the field of raw materials. Between 2000 and 2005, The number of transactions of China’s investment in raw material in Latin America accounted for 40% of total number, and the transaction amount of raw material accounted for 85% of the total amount. By 2007, the three major investment sectors accounted for 23.61%, 35.8% and 38.36% respectively.[1]This trend is expected to continue in the near future.

2.Is interest still driven primarily by SOEs or are you receiving more enquiries from private entities?

Most of clients of DeHeng are still state-owned enterprises, such as China Tobacco, Sinotruk, China Cable, China Railway, etc., and some of them are private companies such as Chang You. It is observed that between 2000 and 2017, in terms of the number of transactions, private companies gradually overtake state-owned enterprises. According to statistics, in 2017, private enterprises accounted for 68.89% of the total investment in Latin America. However, the investment of SOEs still prevails in terms of the transaction amount and the amount of employment created. Between 2000 and 2017, state-owned enterprises invested a total of 91.398 billion US dollars in the region, accounting for 74.59% of the total amount of investment, and the number of jobs created accounted for 52.26% of the total. In terms of investment type, the investment projects of SOEs are concentrated in capital-intensive sectors, and the average scale of the projects is larger than private companies, while the private enterprises mainly focus on new investment projects with smaller scale and less capital intensity. [2]

3.Which countries are proving to be most popular for Chinese investors entering the Latin America market?

From 2000 to 2017, China’s foreign direct investment in Latin America mainly flowed to Brazil, Peru and Argentina. The aforesaid three countries absorbed 72.61% of China’s total foreign direct investment in Latin America, and created 62.47% of the total employment in the region. Among them, investment Brazil is mainly concentrated in public utilities, oil and gas, and manufacturing. Investment in Peru is mainly in metal, minerals, oil and gas, agriculture, forestry, husbandry and fishing. China’s investment attracted by Argentina is mainly in oil and gas, retail and manufacturing. industry. [3]

4.Which sectors are you seeing most interest in?

Raw materials, manufacturing, agriculture, infrastructure, and services. (As mentioned above)

5.What are the advantages and disadvantages of investing in Latin America for Chinese entities?

Advantages:

First, Latin America is rich in natural resources. As a very important source of bulk commodities, rich resources and vast markets of Latin America make it full of potential business opportunities.

Second, Latin American countries are in great need of investing in their own infrastructure, some countries have proposed to double the current level of infrastructure investment. This provides a broad range of investment opportunities for Chinese companies.

Disadvantages:

Chinese companies investing in Latin America face multiple risks in politics, economy and finance.

Political risks: Political risk is currently the main risk faced by Chinese companies investing in Latin America. Political risks involve many aspects, such as government instability, changes of socio-economic environment, changes of investment promotion policies, internal and external conflicts, corruption and so on.

Economic risks: Latin American countries have long been in a growth predicament, and the sluggish GDP growth rate is sometimes difficult to guarantee the return on investment of enterprises. Moreover, Latin American countries still face problems such as undiversified economic structure and heavy dependence on natural resources export.

Financial risk: Latin America, as a region with a relatively high degree of financial openness among developing economies, is more susceptible to external shocks, which may in turn trigger financial risks. Meanwhile, Latin America is a region with large external debt scale and high debt default rate, which may add to its financial volatility.

6.What effects is Chinese investment having on pricing?

China's influence on pricing in Latin America is mainly reflected in prices of bulk commodities. Latin America is an important source of bulk commodities for Chinese market. Therefore, changes in China's macroeconomic and investment situation will indirectly affect the pricing of bulk commodities in Latin America. Brazil is positioned as a major supplier of bulk commodities for China because of its abundance of iron ore, oil, soybeans and beef etc. Due to China's economic slowdown and reduction of investment in recent years, prices of bulk commodities in Brazil have been reducing. The world's largest iron ore producer, Vale, based in Rio de Janeiro, is already closing its mines and cutting spending.

7.What are the challenges for Chinese investors wanting to invest in Latin America? How can they best plan those challenges in advance?

First of all, Chinese companies wanting to invest in Latin America may face the challenge of coordinating relationships among various stakeholders. The geographical distance between Latin American countries and China, as well as the huge differences in language, culture, social customs and legal norms, have caused considerable problems for Chinese enterprises. Especially at the political level, affected by historical and social development factors, the elite ruling class in Latin American countries is seriously separated from the lower groups, with different demands and conflicts on both sides. The ruling party and the opposition are often at odds. The media, which plays an important guiding role in public opinion, is often controlled by different parties and local interest groups. As a result, once Chinese enterprises investing in Latin America fail to coordinate various type of relationships, they will be potential risk of being attacked and blamed by different interest groups.

Secondly, a large number of China’s investment in Latin America is driven by government authority. The officially-led, government-driven investment model could lead to an impact on other Latin American stakeholders and cause a series of troubles. On the one hand, there may be cases where the investment project does not match the local market demand. On the other hand, some investment opportunities are created by Chinese government through high-level exchanges, so that Chinese companies may get support of financing and market development. This may result in negative impact on relevant stakeholders, such as the attack from opposition parties or local competitors etc.

Suggestions���:

For the above challenges, Chinese investors may try the following adjustments to best plan in advance. Chinese enterprises should strengthen their management, actively establish internal control of compliance, accelerate the localization of enterprises, comply with local laws and regulations and adhere to business ethics. Meanwhile, Chinese enterprises may also strengthen investigation and supervision of local business partners to avoid being responsible for unlimited joint and several liability. Investors should learn from the experience of risk management from some international companies, strengthen the estimation of potential risks and work out risk control plans in advance.

Second, Chinese investors should continue to optimize and expand investment areas. Latin American countries are now adjusting their investment strategies to reduce the proportion of FDI inflow of energy and mineral sectors. Chinese companies may follow this trend to increase investment in high-tech industries such as manufacturing, telecommunications and clean energy, and make more contributions to local scientific and technological innovation.

8.Do Latin America-based clients understand how Chinese entities operate? What are the common issues you encounter?

China and Latin American countries differ greatly in ideology, economic structure and level of development, so Latin America-based clients still have a lot of misunderstandings about how Chinese companies operate. Latin American people’s understanding of China can be seen from several Spanish words about China in daily life :(1) UN pais en la luna (China is remote and mysterious); (2) Estoy en China, No se nada (China is big, mysterious and difficult to understand); (3) trabajar como chinos (working like a Chinese); (4) Paciencia como chinos (patient as Chinese); (5) co-chinos (dirty like Chinese); (6) Cuantos Chinos (There are a lot of fakes in China).[4]As a result, Latin American companies may also have misconceptions about Chinese companies, including that Chinese companies are not trustworthy and do not take social responsibility. [5]As China's investment in Latin America continues to grow, it is not uncommon to blame Chinese companies for not complying with the social responsibility of the host country.

9.What is the most common question China-based clients ask you when dealing with Latin American investments?

The most common questions China-based clients ask when dealing with Latin American investments are the local policies of host countries, including labor policies, environmental policies and tax policies, etc. In terms of labor policies, due to the high degree of democratization in Latin America, the strong awareness of ordinary citizens in political participation and the large power of trade unions, Chinese enterprises have encountered labor problems for many times because of great difference in labor protection. In terms of environmental policies, Chinese companies often have to comply with the complex administrative licensing system of the investing country. For example, in Brazil, Chinese investors need to deal with cumbersome environmental approval process to carry out construction project. Finally, in regards to tax policy, Latin America countries generally have complex tax systems with lower stability. Brazil's tax policies are complex and complicated, and the central and local tax systems are also different. Therefore, how to make a good tax planning is also a major issue for Chinese investors.

10.Are Chinese corporate counsel playing a greater role in their companies’ business matters in Latin America?

Corporate councels are playing an increasingly important role in Chinese investment in Latin America. As Chinese investment in Latin America increases, the biggest obstacles facing Chinese companies are tax and legal issues. Corporate advisers can better help Chinese companies operate in Latin America in areas such as tax and law. In addition, there are great cultural differences between China and Latin America, and Chinese and Latin American investors think and behave in very different ways. In this case, professionals are needed to provide solutions in cross-border transactions.

At present, Chinese and Latin American parties usually stipulate dispute resolution clauses as negotiation, arbitration or litigation, and enterprises rarely resolve disputes through mediation. As more and more countries join the Singapore Mediation Convention, mediation provides another effective dispute resolution for Chinese and Latin American companies. The Belt and Road International Commercial Mediation Center (BNRMC) Internet Mediation System has been developed and put into operation in October 2016. Since its establishment, BNRMC has built a team of experienced professional mediators, consisting of 265 outstanding legal scholars and professionals from all over the world, including China, Ecuador, Brazil and other countries. BNRMC has mediated more than 500 commercial disputes with a success rate of nearly 70% so far. In the future, it is expected that professional mediation agencies and law firms will play an increasingly important role in the mediation of the Chinese and Latin American parties in dispute resolution.

11.How do clients expect their China and Latin America-based firms to manage a cross-border matter?

In cross-border investment towards Latin America, China-based clients mainly have the following expectations: first, the clients expect that they can strengthen their adaptability to the investment rules of the host countries, get command of a good predictive ability of local economic development strategies, regulations, and policy trends through the assistance of corporate councels and through due diligence. Second, the clients hope that they can strengthen cultural integration and the localization of enterprises. Third, they hope to better manage and control the risks of exchange rate, and use various financial instruments and legal protection clauses to avoid exchange rate risks.

12.What are the future trends in China to Latin America investments?

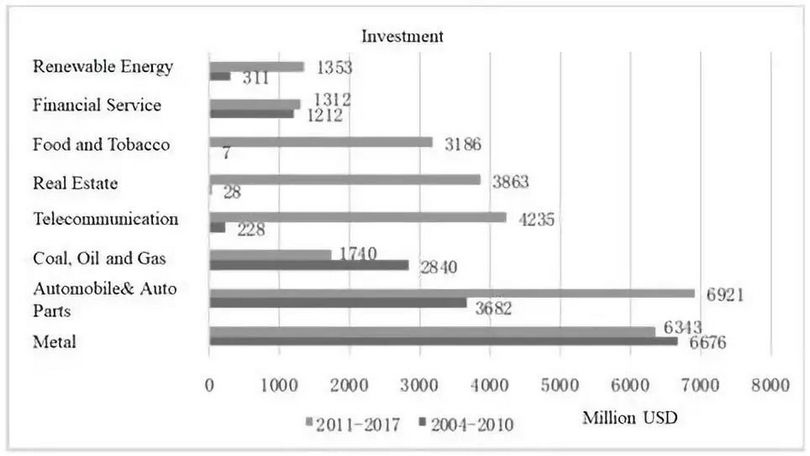

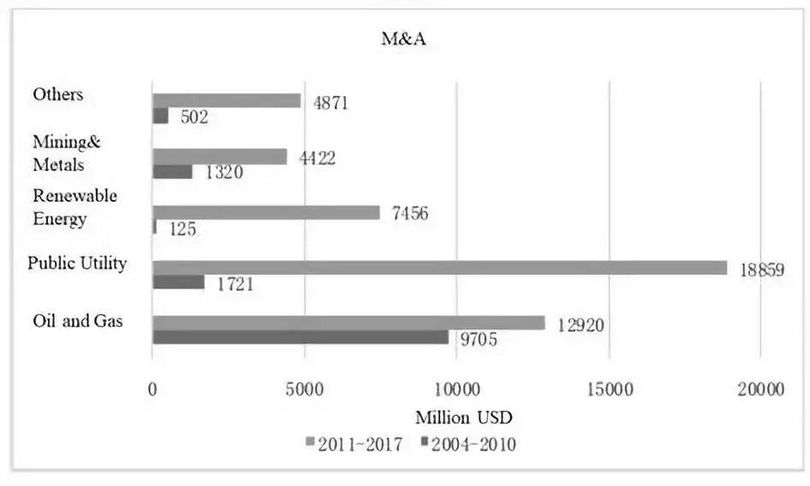

The investment field will gradually become more diversified. As Huawei and ZTE entered the telecom industry, BYD Auto, Chery Automobile and Jianghuai Automobile entered the automotive industry, China's investment diversification pattern in Latin America has gradually been established, and manufacturing, infrastructure and agricultural sectors gradually became new growth points. According to the ECLAC report, in 2004-2010, metal and fossil fuels accounted for 42% and 18% of China's announced investment in Latin America respectively, and by 2011-2017, the proportions of the two fell to 20% and 6% respectively. In contrast, China's investment in Latin America's telecommunications, real estate, food or renewable energy industries has risen. In terms of mergers and acquisitions, the energy sector has been the main target for Chinese companies to conduct M&A in Latin America. In the future, China's M&A in the fields of oil and natural gas and renewable energy are expected to continue to increase, and M&A in the public utilities sector is expected to be increasing.

China’s Investment and M&A in Latin America (From 2004 to October 2017)

Source: CEPAL���,Exploring new forms of cooperation between China and Latin America and the Caribbean���,Jan.2018���,p. 57.

Greenfield investment will gradually increase. In the past, China's investment in Latin America was mainly in the form of M&A and there was less greenfield investment. Compared with multinational companies from developed countries that have been working in Latin America for years, Chinese companies have little experience in terms of negotiation, operation and risk control. Therefore, assets acquired in Latin America through M&A can be quickly integrated into the local market and transaction costs can also be reduced. With the accumulation of practical experience and deeper understanding of domestic demand in Latin America, Chinese enterprises' greenfield investment in Latin America will increase correspondingly, and this trend may be more obvious in the manufacturing industry.

Notes

[1]Dussel Peters, Enrique. 2019. Monitor de la OFDI deChina en América Latina y el Caribe2018. (Report on China's directinvestment in Latin America and the Caribbean in 2018) México: Red ALC-China

[2]Ibid.

[3]Xu Peiyuan, Wang Yongzhong, Crossingthe "Fog" of Latin American Investment, China Forex, Issue22, 2018

[4]The Top Ten Causes ofMisunderstanding of China in Latin America Reflect Self-Understanding Paradox���,Hexun, http://opinion.hexun.com/2015-01-11/172258636.html(accessed 10 Sep 2019)

[5]Jiang Shixue, Six Misunderstandings in theRelationship between China and Latin American Countries, Ming Pao News,http://www.charhar.org.cn/newsinfo.aspx?newsid=14393 (accessed 10 Sep 2019)

Author���:

Harrison Jia

Partner/Lawyer

Mr. Jia Hui practices mainly in the fields of M&A and insurance. He is qualified to practice in the New York State and China. Mr. Jia is an admitted lawyer in the field of international investment legal affairs by MOFCOM. He is also the Chairman Assistant of BNRSC, Deputy Secretary of New Energy International Development Federation, Representative of Chief Lawyer Counsel of China Insurance Association, Member of Legal and Compliance Committee of China Insurance Asset Management Association.

E-mail���:jiahui@cqhaolun.com

Ju Guang , legal assistant of DeHeng Law Offices (Beijing), is Master of Science of Nanyang Technological University and LLM of City University of Hong Kong. She practices mainly in the fields of cross-border investment and M&A.

E-mail���:juguang@cqhaolun.com

This article was written by the lawyer of DeHeng Law Offices. It represents only the opinions of the authors and should not in any way be considered as formal legal opinions or advice given by DeHeng Law Offices or its lawyers. If any part of these articles is reproduced or quoted, please indicate the source.

声明���:

本文由k8凯发天生赢家·一触即发律师事务所律师原创���,仅代表作者本人观点���,不得视为k8凯发天生赢家·一触即发律师事务所或其律师出具的正式法律意见或建议。如需转载或引用本文的任何内容���,请注明出处。